Managing compliance is a priority for law firms. Make meeting your CQS compliance requirements easier with these 11 solutions from InfoTrack.

11 ways InfoTrack can help improve your CQS compliance

Are you still trying to find ways to make managing your compliance requirements simpler? With more than 3,500 law firms accredited under the Law Society Conveyancing Quality Scheme (CQS), the changes which took effect to the Core Practice Management Standards from 1st May 2022 mean firms need to re-evaluate how they are managing their compliance.

We recently caught up with Lead CQS Assessor, Tracy Thompson following her discussion at the Digital Conveyancing Summit – if you missed it, you can catch up on-demand here. She discussed with us what changes took effect earlier this year and how technology can aid law firms’ CQS compliance.

Read on to find out how InfoTrack’s digital tools can help your firm to manage their compliance requirements.

What were the updates to the Core Practice Management Standards (CPMS) in May 2022?

On the 1st May 2022, new Core Practice Management Standards took effect. Law firms accredited under the Conveyancing Quality Scheme need to make themselves aware of the updates and what they need to do to ensure they remain compliant. The previous standards had been in place for 12 years and required realignment with the current conveyancing climate, including risk assessment and technology.

The updates were designed to increase credibility of the CQS and enhance the standards which law firms follow. On-site assessments commenced from the 1st May 2022 with the new CPMS in place. For the complete guidance for the Core Practice Management Standards, access them here.

What outcome can you receive from a CQS assessment?

If your firm undergoes a CQS assessment, there are three possible outcomes in line with the new CPMS. These outcomes include:

- Demonstrate full compliance with CQS

- Minor non-compliance with 21 days to correct

- Major non-compliance with three months to correct

The assessment is completed by an accredited CQS assessor and reviews 40 individual assessment requirements across seven sections. It’s important to note that the CPMS is not prescriptive in the technology or processes you use, but instead focuses on how you can evidence compliance with the assessment requirements.

How can InfoTrack help you meet your CQS compliance requirements?

Law firms must be able to evidence how they are compliant with the procedures and policies they have in place. Technology can have a key role in providing that evidence with ease. It reduces a significant amount of manual administration and minimises risk associated with paper.

Technology can play a vital role in enabling firms to document their procedures and policies and then provide a digital audit trail to show that they are being adhered to by the firm. Tracy says that:

‘Technology is really, really important in ensuring consistency in your approach’ and ‘choosing the right tech is absolutely essential, because paper is a risk’.

Understanding how important minimising risk is for law firms and the need to adhere to compliance requirements, we’ve worked with industry bodies and law firms to help shape digital tools that make evidencing compliance easier. Here are 11 ways that InfoTrack can help law firms with their CQS compliance.

1. Digital audit trails provide easily documentable evidence

One of the most important parts of proving your compliance with the CPMS is to provide evidence. Using a single system with digital audit trails makes managing the documentation to evidence your compliance adherence simple and saves hours usually associated with the manual collation of checking files and gathering paperwork.

2. One platform provides standardisation across the conveyancing process

Using one platform to manage all your key conveyancing tasks provides consistency across the process. This means complete visibility across the entire matter, one invoice which provides ease for reconciliation with finance departments, and can also help with information management related to GDPR, privacy policies, and security policies.

3. Digital ID verification is more secure

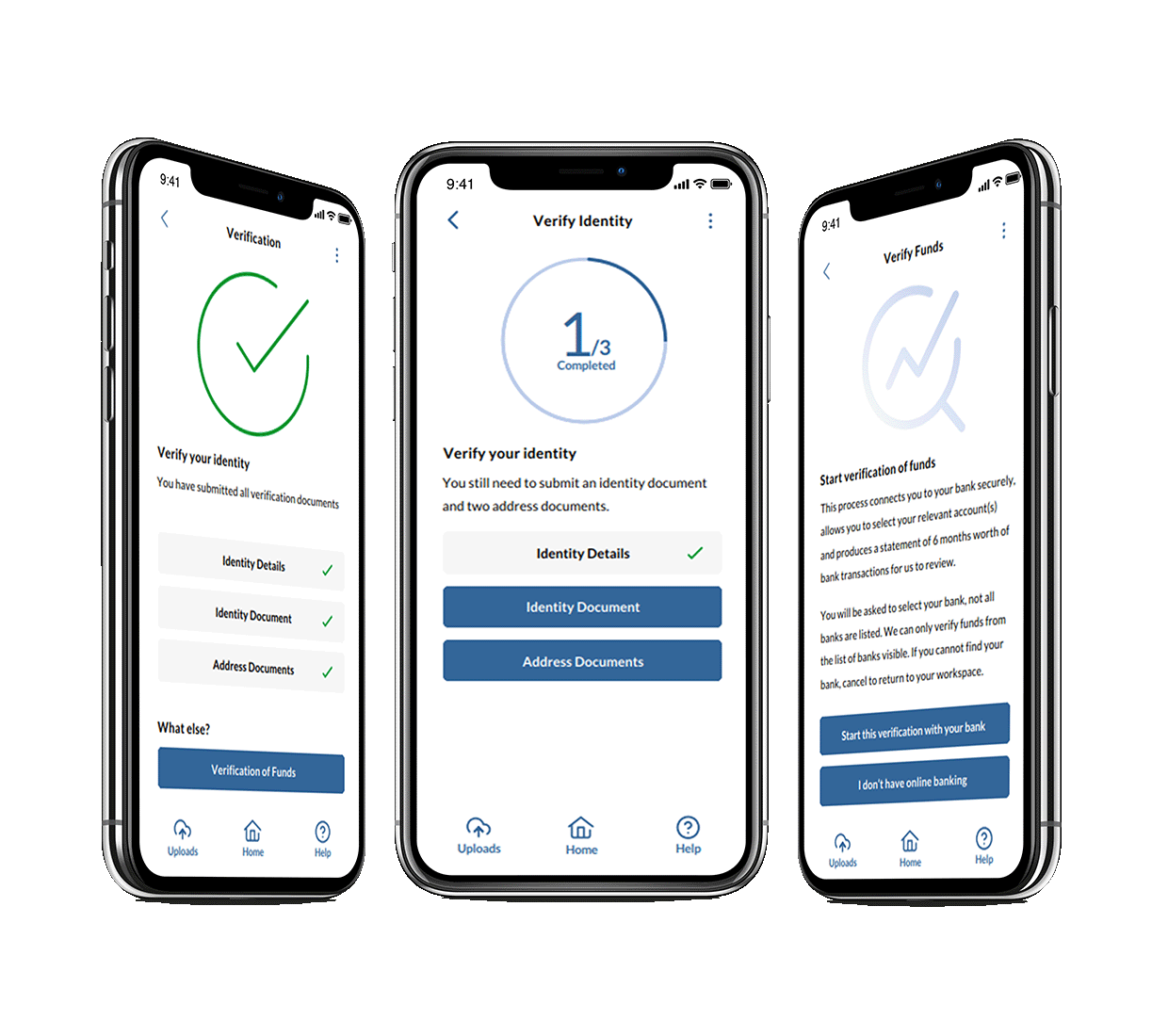

Fraudsters continue to get smarter year-on-year, which is why the technology to tackle identity fraud needs to keep pace. eCOS is the complete digital onboarding solution that encompasses digital ID verification, source of funds checks, TA forms, onboarding questionnaires and client care letters within a single, user-friendly portal.

By using eCOS to complete CDD with digital ID verification, you can trust that the biometric data used is more secure than manual checks of passports and driver’s licenses. Digital ID verification has been endorsed by the government with HMLR launching the Digital Identity Standard in March 2021 which provides Safe Harbour for law firms who follow the guidance in Practice Guide 81. This aligns with being able to evidence compliance with the CPMS because it uses technology that shows how you verify a person’s ID and provides a digital record of that verification.

4. Digital Source of Funds and AML checks improve client due diligence

Using Open Banking technology to assess and verify a home mover's Source of Funds not only saves time otherwise spent manually collating and analysing printed bank statements, but also helps firms to evidence their procedures for completing their customer due diligence. Our Verification of Funds tool helps you make an assessment of your client’s Source of Funds with ease.

5. Property Report helps to accurately communicate Leasehold information to homebuyers

Preparing a Report on Title is a time-consuming process that involves collation of a lot of information, analysing the data and then presenting it in a format that the homebuyer can understand. Property Report, the only search data-driven Report on Title solution, uses automation to collect the information, scrutinise the data for inconsistencies, and prepare the report in an easy-to-understand format for the homebuyer.

You can reduce the risk of human error by using digital tools to gather information from various searches, the SDLT information, specific details related to leasehold data, and then allow the technology to flag inconsistencies in the information or missing details. Property Report also provides a complete audit trail of all changes tracked to make reporting updates easy to refer back to.

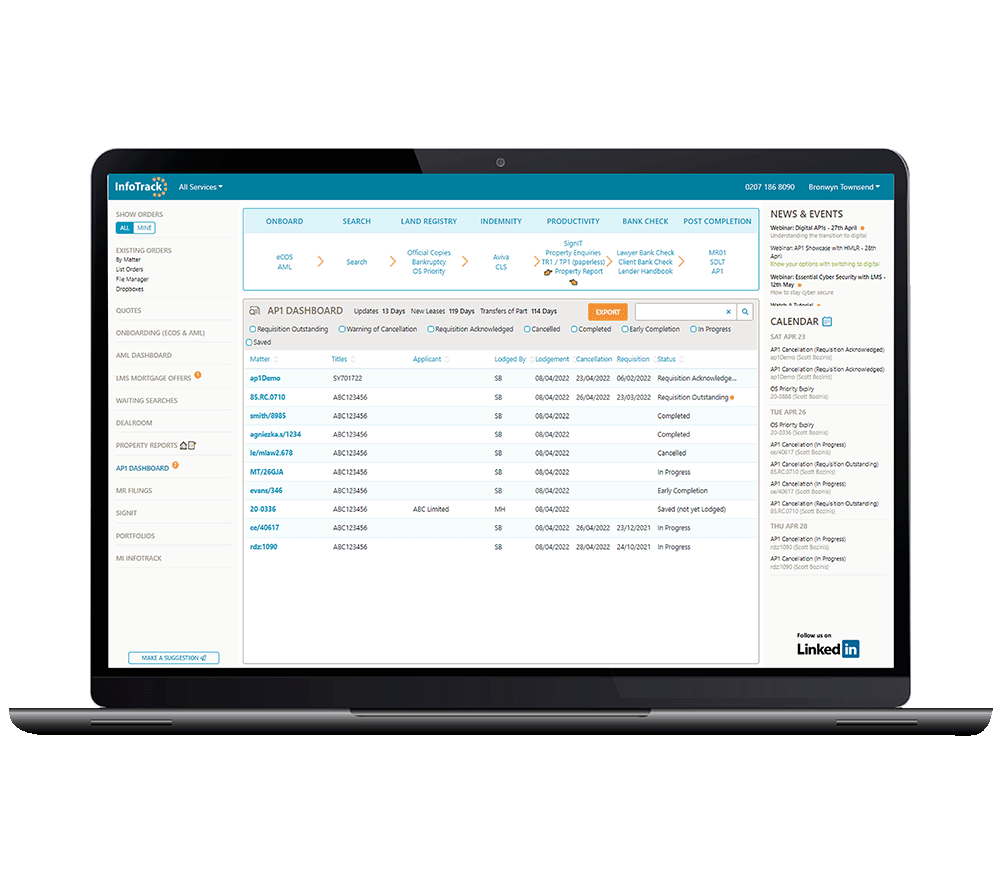

6. An Intuitive AP1 dashboard means you never miss key dates

Staying on top of everything including expiring priority searches and upcoming AP1 cancellations is a must for law firms. Our intuitive AP1 dashboard provides visibility over every application across your firm, including the ability to sort applications by status. You’ll also have access to a WhatsApp-style messaging system to respond to HMLR requisitions and can make use of in-built validations to reduce the risk of requisitions by up to 30%. Tracy says:

‘The ability to be able to manage key dates provides consistency and helps manage risk, as missing a key date is going to lead to, at best a complaint and worst an evidence claim.’

7. SDLT

It is imperative to ensure that clear and timely advice on Stamp Duty Land Tax (SDLT) at the outset and throughout is available. Our Stamp Duty form is ready to support your policy from the get-go, allowing you to accurately calculate and verify the amount payable including working out payments for first time buyers and major interests in a dwelling. Our Stamp Duty Calculator is always accurate – any changes to legislation are immediately incorporated into our software allowing you to report back any changes to payments efficiently. Compiling and submitting the SDLT through InfoTrack allows you to digitally store the return form (and the Land Transaction Return Form) making it easy to evidence your process.

8. LMS integration automates Lender updates

Keeping lenders up to date is essential but remembering to stay on top of this process can be difficult for busy conveyancers. By using automated updates via InfoTrack’s integration with LMS, you take away the burden of manually informing Lenders of milestone document updates linked to your priority searches (OS1 & OS2) and AP1 registration.

9. Improve due diligence with bank account checks for clients and other law firms

Cybercrime grows ever more sophisticated every year. To minimise risk, you can complete bank account checks on your clients and the other side before depositing any money – you want to know who you’re sending the funds to. We’re integrated with Confirmly and Lawyer Checker to provide a fast, trusted, and secure law firm identity checking technology which also help you to evidence your due diligence.

10. CMS integration provides a single source of truth

Having your case management system integrated with InfoTrack provides a single source of truth which adds consistency to your process and minimises risks. It minimises the risk of errors related to rekeyed data, documents and searches being uploaded to the incorrect matter or not at all, and delays caused by misplaced information and results.

11. User support and training ensures your whole team stay on top of updates

One trend that Tracy has seen that hampers firms CQS compliance efforts is a lack of training. In section four of the Standard it outlines people management, which includes new learning and development requirements that didn’t appear in the 2019 version.

Keeping staff trained and up to date on policies and processes will help with ensuring they are meeting the compliance requirements. InfoTrack provides a dedicated account manager, ongoing training and development, and a knowledgeable Helpdesk team to make sure your firm have all the support they need.

Having the right technology in place is just part of the puzzle, ensuring staff are trained regularly and stay up to date with how to use the technology to meet requirements and procedures is also important.

How can we use technology to demonstrate CQS compliance?

While the CPMS isn’t prescriptive in which systems or processes you use to meet your compliance requirements, Tracy does recommend law firms follow a three-tier process to demonstrate compliance.

1. Say as you do – create documented policies and procedures that are specific to your firm.

2. Do as you say – ensure those policies are being followed and that all staff are trained adequately.

3. Provide evidence – make sure everyone is aware of how the standard is being complied with and how you can show that during an assessment.

To find out more about how InfoTrack can help you make light work of meeting your CQS compliance, request a call with one of our legal technology specialists today.