Looking to digitise your conveyancing process? Here are five types of technology that digitally savvy law firms are using to save time and manage risk better.

Five digital conveyancing technology solutions leading law firms are using

We recently launched an industry-first assessment to measure the digital capabilities of law firms’ conveyancing processes – the Digital Conveyancing Maturity Index. What we found was that the average level of digital conveyancing maturity across the industry came in with a score of 43%. While that’s the average, there were the top 5% who scored above 80% - indicating a healthy level of digital adoption.

"The industry average may not have quite reached a ‘pass’ yet, although the findings do suggest there’s still plenty of room for opportunity within law firms when it comes to leveraging technology."

Firm size by staff numbers building their own technology

If we zero in on what the top-scoring firms from the Digital Conveyancing Maturity Index are doing, we can understand what technology is being adopted fastest, which areas of the conveyancing process are most and least digitised, and how other firms can learn from this so that they too can reap the rewards of focusing on the move to digital conveyancing.

Law firms that have adopted digital tools are accessing benefits their peers are not; time-savings, improved productivity, and better risk mitigation. The solutions these high-scoring firms are adopting cover the entire conveyancing process from new business management and client onboarding to post-completion.

So, what are the lessons we can learn from these digital early adopters? Based on the Digital Conveyancing Maturity Index, here are five digital solutions that tech-savvy firms are using.

1. CMS integration is crucial

Law firms who scored highest overall and the maximum possible marks in the areas of the conveyancing process assessed in the Digital Conveyancing Maturity Index, are integrating their conveyancing service providers with their case management system. Not a simple link, but complete two-way integration.

So, what is two-way integration? Designed to streamline your conveyancing workflow and provide a single source of truth, case management integration with InfoTrack helps firms maximise every opportunity. CMS integration gives you the ability to:

- Save time and reduce errors with pre-population using data from your matter

- Automate time-consuming administrative tasks

- Minimise the risk of re-keying errors

- Return all searches and documents to the matter in your CMS automatically

- Automatically return disbursements to the ledger

- Centralise information to provide a single source of truth and ensure complete consistency across your matter

Top-performing firms in the Index are already doing this, so if you aren’t making the most of CMS integration, it’s a great way to improve your use of technology and realise real business benefits.

2. Automation is saving time and reducing risk across every stage of the conveyancing transaction

The pre-completion process is the least mature area of the conveyancing process, according to the findings of the Digital Conveyancing Maturity Index. Firms here reached an average score of just 30%.

Pre-completion is the largest and most laborious part of the process, making it the biggest area for opportunity when it comes to digital adoption in conveyancing, with automation able to remove many of the pain points of previously manual processes.

"Automating administrative tasks can have a positive impact on law firm productivity, saving firms hours on time-consuming processes."

The three most common areas where firms in the Index have adopted technology are:

- Automating client communication. Client portals and apps are aiding the management of time-consuming client updates, by freeing up more of their time to focus on progressing the transaction and managing new business.

- Automating reports on title. Technology can be used to collate data and pre-populate the necessary information to be included in a report on title. Our Property Report solution makes light work of the title reporting process by analysing key data to prepare a comprehensive report for the home mover. This technology not only saves you time but helps you to manage risk by flagging inconsistencies in the information provided.

- Automating lender updates. More than 70% of firms who have automated their lender updates with lender panels scored in the top 50% of respondents. It’s keeping lenders updated quickly and ensures the transaction can keep moving without needing to manually check and update the information within the matter.

3. eSignatures can and should be used

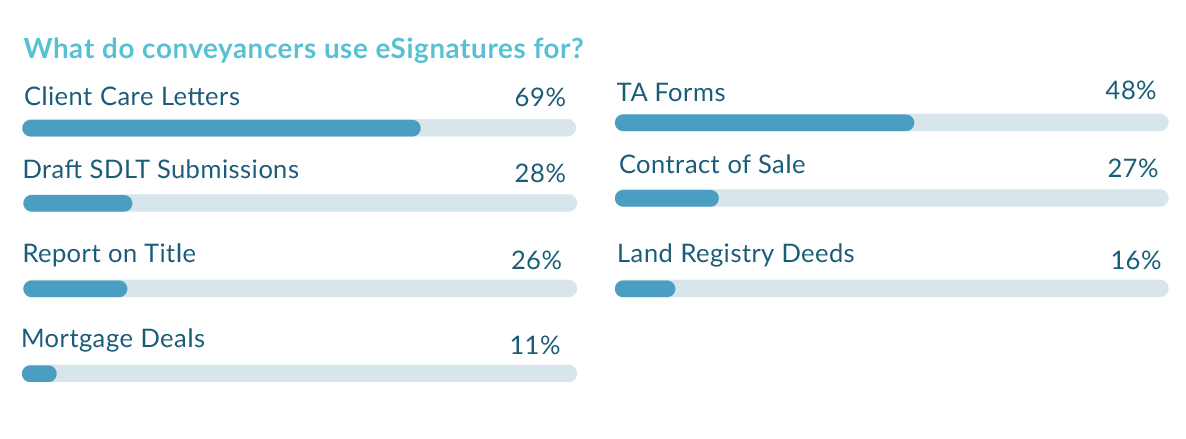

"78% of firms are already using eSignatures, but their use isn’t adopted consistently across the entire process."

The highest use of eSignatures is for client care letters (69%), but progress has been considerably slower where HM Land Registry and mortgage deeds are concerned, with just 16% and 11% adoption respectively.

The pandemic catalysed the use of eSignatures across most of the conveyancing process and this has continued in the ‘new normal’. With recent announcements from Nationwide around the acceptance of eSignatures, and a similar statement from HM Land Registry in July 2020, every law firm should be using them wherever possible in their conveyancing process.

So how should you go about making full use of eSignatures in your conveyancing process?

- If you’re already using eSignatures for part of the process, ensure you’re using them for Land Registry and mortgage deeds, not just onboarding.

- If you’re not using them at all, eSignatures are one of the quickest ways to incorporate digitisation into your conveyancing process and you’ll see the rewards swiftly, through a dramatic reduction in time spent waiting for, and chasing signed documents

4. Dashboards are the key to transparency

A major advantage of digitisation is greater transparency across every stage of a transaction. From visibility over your client’s completion of their onboarding information to staying on top of key dates such as expiring priorities and requisitions with our AP1 dashboard, for example, digital audit trails are helping firms keep on top of every matter.

22% of respondents in the Digital Conveyancing Maturity Index are already taking advantage of the visibility provided by digital dashboards, aiding their compliance and risk management as well as helping them stay on top of their caseloads.

PI insurers are also now considering how the information provided through these digital audit trails can affect renewals.

5. Digital client onboarding is a must-have

The pandemic changed how most law firms managed their client onboarding process. Manual pass checks and printed bank statements are out, while digital ID verification and Open Banking technology is in.

"Changing client expectation around technology also needs to be addressed by law firms and align with the technology they provide – starting with the client onboarding process."

Most first-time buyers are now tech-native Millennials and soon-to-be homebuyers from Gen Z. They expect convenient, accessible technology that suits their lifestyles. Our eCOS solution provides a consumer-friendly client portal that gives you complete visibility over the client onboarding process with everything you need in one secure, smart system. From TA forms, digital ID verification and source of funds checks to client care packs and onboarding questionnaires, everything is possible within a single, sophisticated digital solution.

Most firms have kept those new systems of client onboarding in place, with 66% of firms now completing their client ID verification digitally, and 40% of firms using Open Banking solutions. Join them and modernise your client onboarding process to improve your compliance (and proof of compliance), minimise risk for you and your clients, and deliver an exceptional client experience from the start.

Get your free digital conveyancing maturity assessment

It's clear that the tools and services to enable end-to-end digital conveyancing are available to law firms now. To find out just how the industry is performing, download the complete Digital Conveyancing Maturity Index report here.

Access your own free digital conveyancing assessment by completing the short survey that takes less than 10 minutes, and you'll receive a personalised report on your firm’s digital capabilities in conveyancing.